If you have a poor credit history, a huge outstanding debt, or little assets, you might find qualifying for mortgages difficult. In such a scenario, banks and mainstream lenders might not approve your loan request. Even if they do, the interest rates can be high and terms and conditions more rigid. Also, if you are a land investor, waiting for a green signal from the banks can be quite time-consuming and risky.

What if there was a way to skip the queue and buy land right now while you build the finances? Enter land for sale seller financing. This is a unique arrangement between the seller and the buyer of the land. With this procedure, you can buy land without opting for traditional mortgages from lenders. To know what seller financing is, how it works, and the benefits and disadvantages of seller financing, read this blog till the end.

Table of Contents

What is Seller Financing in Real Estate?

To understand whether or not to buy a land for sale with seller financing, you must have an idea regarding what it is.

So, to answer, what is seller financing? It is an arrangement where the seller finances the buyer instead of a traditional lender. In land-for-sale seller financing, the seller extends credit to the buyer, who makes agreed-upon payments over time. This means you can buy land by borrowing the required amount from the seller. The seller, in exchange, will require you to pay an upfront amount and will hold the land in question as leverage until you repay the entire debt.

In this financing method, both parties negotiate the terms, including the interest rate, repayment schedule, and down payment. Seller financing home transactions or land investments usually involve properties where traditional financing is challenging.

This might make you question, "Is seller financing a good idea?". Well, it depends on your or the buyer's financial situation and the seller's willingness to accept structured payments. Therefore, understanding seller financing contracts ensures both parties are protected.

How does seller financing work?

To explore land for sale seller financing opportunities in the top states to buy land in the USA, you should also know how it works.

In land investment with land seller financing, the seller and buyer agree on the purchase price, interest rate, and repayment terms. As a buyer, you can choose this financing method for situations where you are willing to avoid the participation of mainstream lenders. If you are a seller, owner financing can be a great option for you to earn passive income before selling the land.

To go ahead with the seller financing on the land procedure, the buyer provides a down payment, and the seller finances the rest. The land contract specifies payment duration and repayment conditions. However, you must remember that by opting for land investment with seller financing, your interest rates on the borrowed amount can be slightly higher than that of banks.

Also on this note, seller financing land contracts differ from traditional mortgages. This is because there is no involvement of a bank. Instead, the buyer pays the seller directly. Payments continue until the full price is paid. This arrangement benefits buyers who may struggle with bank loan approvals.

Types of Seller Financing

Land for sale seller financing comes in different forms. The following types serve different buyer and seller needs.

-

Lease-Purchase Agreement

In this land-for-sale seller financing agreement, the buyer leases the property with an option to buy it later. A portion of the lease payments contributes to the purchase price. This is useful when the buyer needs time to secure financing or build credit.

-

Land Contract

This is another important land seller financing type you must know to invest in land. A seller-financing land contract allows the buyer to make payments directly to the seller while using the land. Ownership transfers from seller to buyer once the full amount is paid. It is common for vacant land and rural properties.

-

Wrap-Around Contract

With this owner-seller financing type, the seller holds an existing mortgage and finances the buyer with a new loan. The buyer pays the seller, who continues making payments to the original lender. This helps buyers get financing for their land investments even when traditional lenders deny loans.

-

Second mortgage

Among the types of land for sale with seller financing, you must also know about second mortgages. A seller can offer a second mortgage while the buyer secures a primary loan from another lender. This method helps cover the down payment or remaining balance, making investing in land easier.

Best Situations to Choose Seller Financing

There are a number of reasons why buyers will opt for seller financing for land for sale over the mainstream methods. If you are unaware of whether or not you need one, professional assistance and a comprehensive land-buying guide will help you make an informed decision. Here are some of the most common situations when buyers opt for seller financing. However, you must note that the reasons behind the seller financing investment property are not limited to the conditions below.

1. Buyer has a poor credit history.

A land investor with a low credit score may struggle to qualify for traditional bank loans. Thus, seller financing on land offers an alternative depending on the buyer's income and ability to make payments rather than focusing on credit scores. This makes land ownership accessible to more buyers while allowing sellers to attract a wider pool of interested buyers.

2. Faster transaction needed.

This is another crucial situation that tends to attract investors towards land-for-sale seller financing. Traditional bank loans involve lengthy approval processes, requiring extensive paperwork and credit checks. With owner-seller financing, the transaction is faster since there is no need for third-party approvals. Buyers can secure the land for sale quickly, and sellers receive payments without long waiting periods. This method, thus, benefits both parties by reducing delays and simplifying the buying and selling process.

3. Property has a high selling price.

You can also consider opting for seller financing for land for sale in the face of a scenario like this. When a property has a high price, securing full financing through banks can be difficult. In such a situation, seller financing investment property allows buyers to negotiate flexible payment terms with the seller, making the purchase more affordable. This arrangement also benefits sellers, as they can attract serious buyers who may not qualify for a large bank loan but can make structured payments.

4. There can be more tax benefits.

Sellers who offer seller financing on land can enjoy potential tax advantages by spreading income across multiple years instead of receiving a large lump sum. Thus, land for sale seller financing may reduce overall tax liabilities, making it a strategic financial decision. Buyers also benefit by avoiding strict loan conditions, while sellers can generate a steady income stream from financing payments.

5. Property is unique.

One of the most popular reasons why buyers are reluctant to let go of a property is its uniqueness. So, if you come across such property but do not have enough funds to make the purchase right away, land for sale seller financing is your go-to option.

Some properties, such as rural land, vacant lots, or unconventional plots, may not qualify for traditional bank loans. So, looking for seller-financing land near me makes these properties more accessible to buyers who struggle to secure mainstream financing. This arrangement enables sellers to attract interested buyers and complete transactions more efficiently. Therefore, for properties that banks consider high-risk or unconventional, seller financing is a good idea.

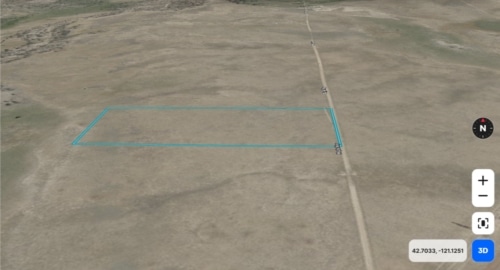

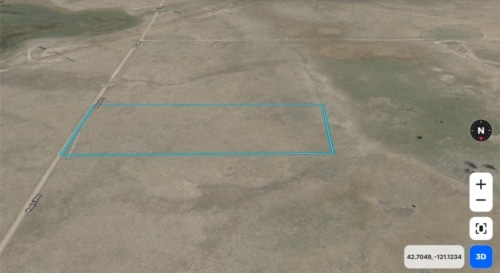

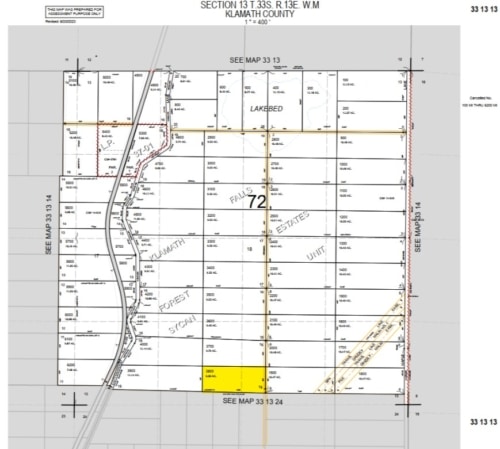

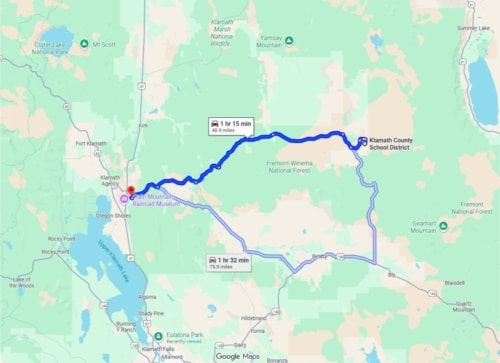

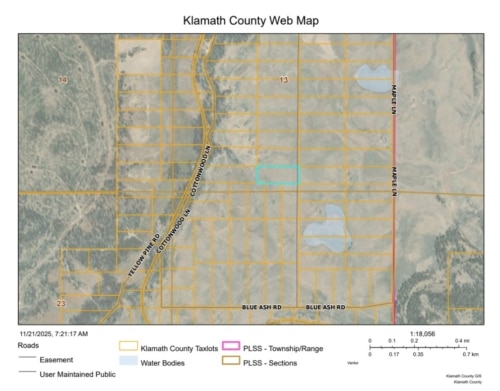

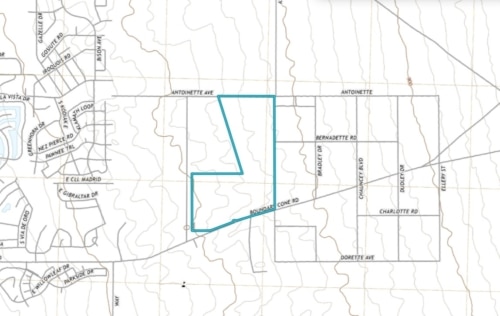

Example of Seller Financing in US Real Estate

In Oregon, Jake wanted to buy a 10-acre property for his family's future home. However, his credit score was below the required threshold for a traditional mortgage. Despite having a stable income and the ability to make regular payments, banks denied him a loan. The landowner, seeing Jake's genuine interest and financial stability, offered the seller financing contract terms. As per this, Jake agreed to a 20% down payment and monthly installments over 10 years. This land-for-sale seller financing arrangement allowed him to secure the land without dealing with rigid bank requirements. Meanwhile, the seller benefited by earning interest on the transaction, ensuring a steady cash flow without waiting for a full payout.

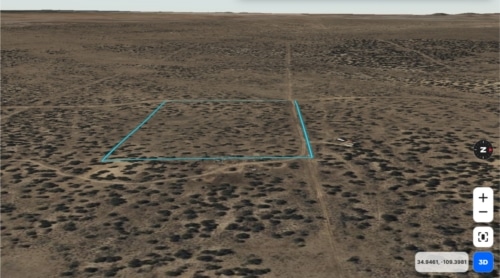

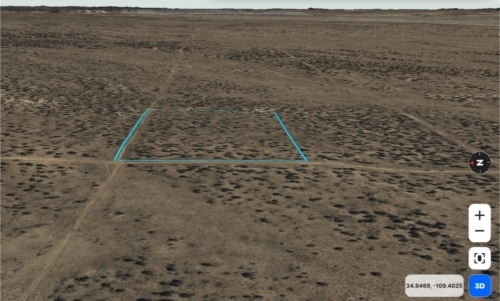

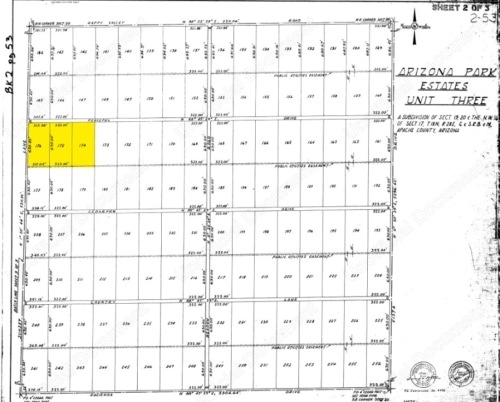

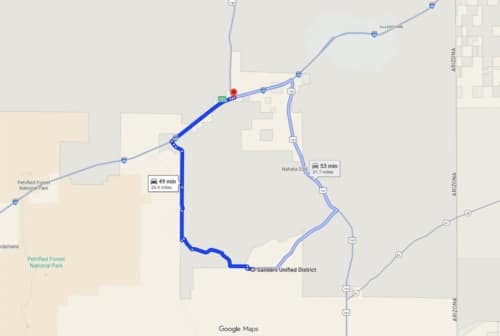

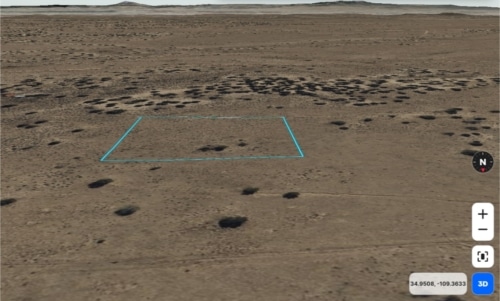

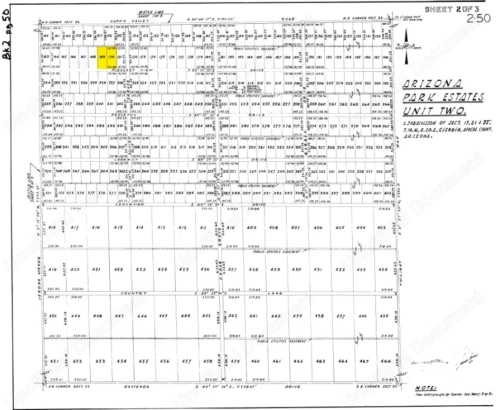

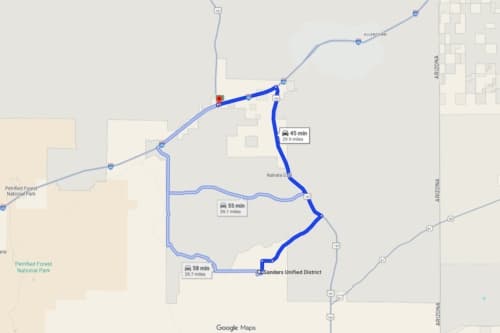

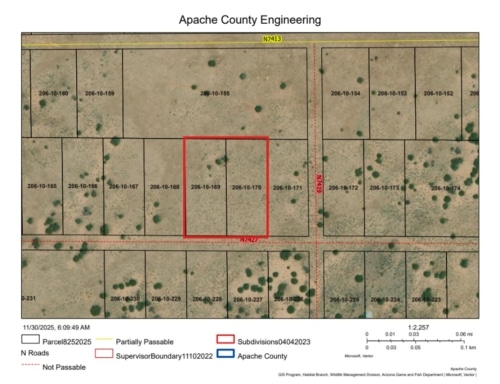

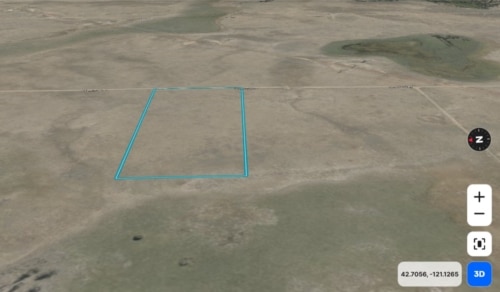

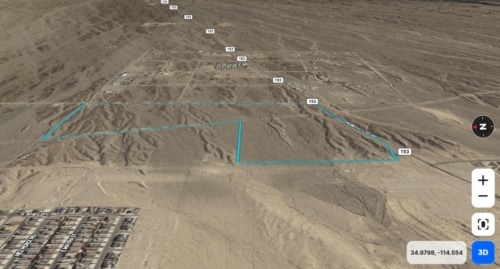

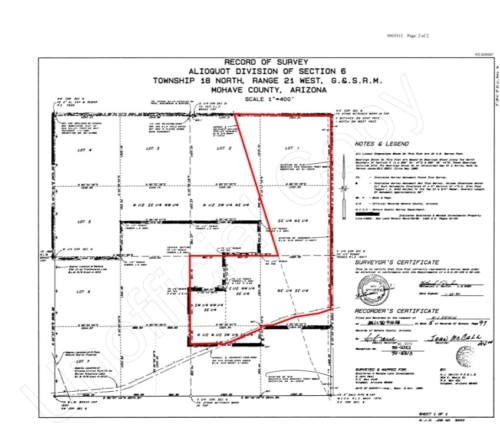

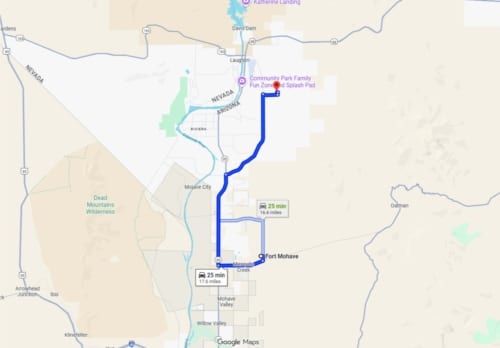

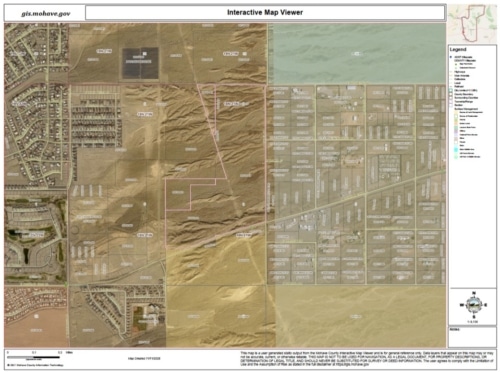

Similarly, in Arizona, Sarah, a landowner, was eager to sell her 15-acre desert property and set up a "land for sale" ad for her property. She knew that many interested buyers faced financing challenges and had to wait in long queues for bank approvals. This potentially could delay the sale for months. To skip these, she chose land seller financing, setting flexible payment terms. Within weeks, she found a committed buyer who agreed to her terms. The deal closed smoothly without bank intervention. This allowed Sarah to quickly transfer ownership while the buyer secured land in a competitive market. Therefore, seller financing land for sale made this transaction seamless for both parties, proving its effectiveness in real estate deals.

Pros and Cons of Seller Financing

Now that you have a detailed idea of what seller financing is and are wondering if seller financing is safe, you must know about its benefits and risks. On this note, here are some pros and cons of seller financing.

Pros

- Faster closing process without bank delays

- Flexible land for sale seller financing terms tailored to buyer and seller needs

- Allows buyers with poor credit to buy land

- Sellers earn interest over time.

- Buyers avoid strict bank lending requirements.

Cons

- Higher interest rates compared to bank loans

- Seller assumes the risk of buyer default.

- Not all sellers are open to this arrangement.

Conclusion

This is everything you need to know about land for sale seller financing and how it helps your land investment and buy now and build later goals. Seller financing land for sale is a powerful tool for buyers and sellers alike. It offers flexibility, faster transactions, and opportunities for those unable to secure traditional financing. However, understanding the benefits and disadvantages of seller financing is essential before proceeding. This shall assist you in keeping the potential risks in mind and treading carefully.

If you are still wondering or have any queries regarding whether seller financing is a good idea for your portfolio, consider seeking professional assistance. You can also connect with our experts at APXN Property or follow our detailed land-buying guide to invest in land with the right knowledge.