Investment should be the top priority for every earner. To make the most of your hard-earned money, your investment decisions need to be wise & profitable.

Your 40s or 50s are the best decades for you to start investing. You have about 15 to 20 years left to continue being an income-generating citizen.

There is plenty of time for you to make some wise financial choices. The sooner you invest, the greater will be your final return since interest on investments can compound over time.

To start your investing journey, it’s crucial to think about your current financial situation and where you want to be when you retire.

It’s alright if your existing reserve fund isn’t nearly as big as you’d like it to be. But to grow it further, you are in the right place to learn about all popular investment strategies to begin investing in your 40s or 50s.

Some top methods to invest in your 40s & 50s are:

Table of Contents

Real Estate ETFs and Mutual Funds

An indirect way to invest in real estate is through the purchase of mutual funds and exchange-traded funds (ETFs).

Here, you do not actually own the underlying asset, even though you are theoretically holding the shares.

One advantage is that these funds are relatively liquid. Another is that they provide investors with a wider selection of assets.

The analytical and research data offered to the investors is another remarkable benefit. It lays a lot of the groundwork for you, allowing you to get extensive real estate exposure by investing a modest amount.

According to investopedia.com:

“There are 32 REIT ETFs that trade in the United States, excluding inverse and leveraged ETFs, as well as ETFs with less than $50 million in assets under management (AUM).

All three of the top-performing REIT ETFs outperformed the broader market in the past year. The S&P 500 has provided a one-year trailing total return of 16.8%. The best-performing REIT ETF over the past 12 months is the Nuveen Short-Term REIT ETF (NURE). The benchmark figure for the S&P 500 above and all numbers in the statistical profiles below are as of Feb. 10, 2022.”

Real Estate Limited Partnerships (RELPs)

RELPs offer a wide range of real estate investment opportunities. This enables you to acquire, rent, develop and sell your assets with other investors that would be difficult for you to maintain or afford.

RELPs are not traded on public exchanges; they are a type of private equity. They have a fixed lifespan which usually ranges from six to twelve years. During this time, RELPs conduct business by developing a strategy, sourcing assets, and sharing revenue.

These are generally more suitable for wealthy investors. This is because most RELPs ask for a minimum investment of $2,000. So it can be an excellent way to start real estate investing in your 40s if you have the extra money.

Real Estate Investment Trusts (REITs)

Companies that finance or own real estate assets are known as REITs. Shares of these companies are available for purchase on the stock market.

REITs allow you to invest in real estate without owning the actual property.

It is a great alternative for real estate investing because the company typically distributes dividends to investors equal to 90% of their annual earnings.

Additionally, unlike other forms of real estate investing, publicly traded REITs offer flexible liquidity. This means that in the future whenever you need immediate cash, you can sell these shares on the stock exchange.

reit.com states that:

As on December 1, 2021, REITs are up around 29% with strong performance across all sectors.

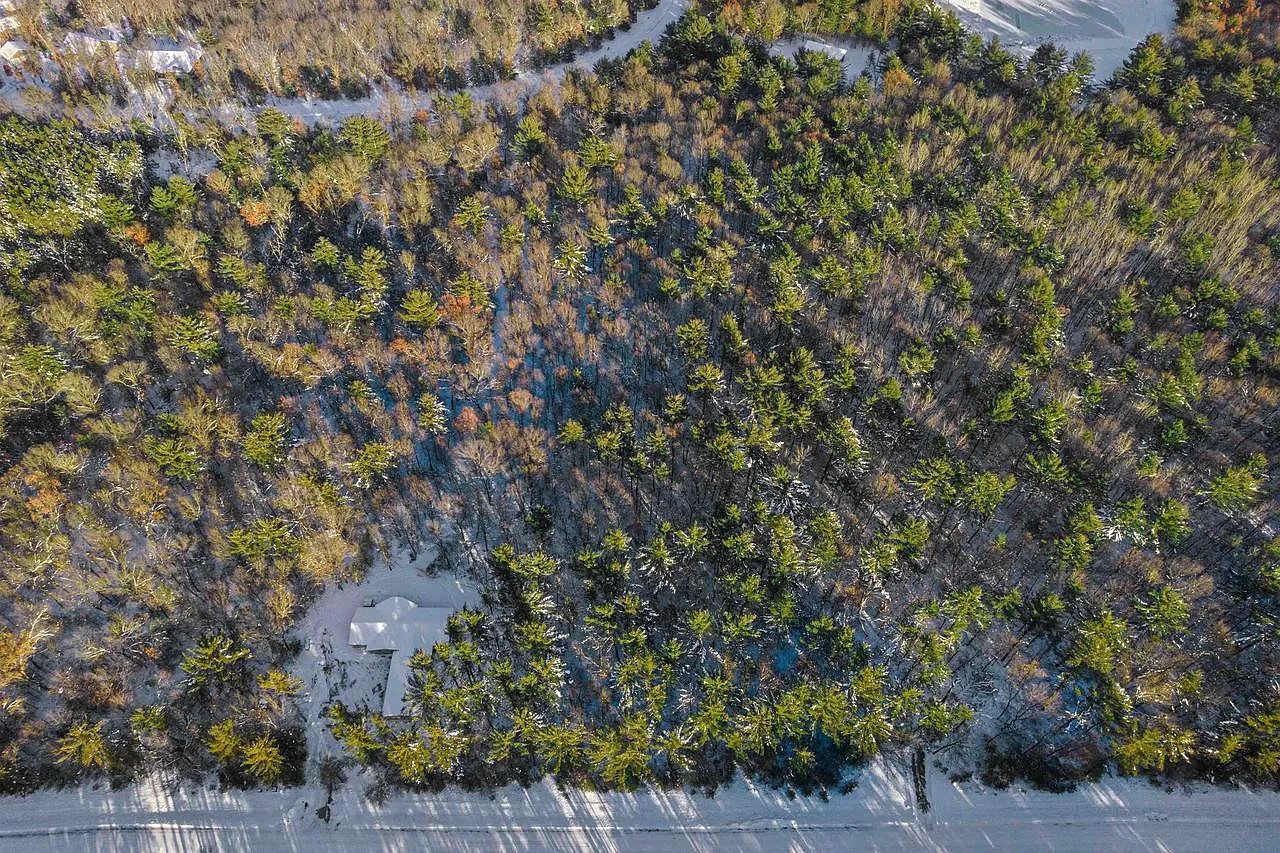

Rental Properties

Leasing a property or a portion of a property is a popular real estate investment strategy. It is a fantastic option for those who have the patience and ability to manage tenants.

There are many forms of owning a rental property – from buying and renting a single-family home. This method is profitable only if your total cost is minimal.

Another approach is to buy a building with multiple units, where you can live in one unit while renting out the others. This method reduces your living expenses, as well as generates revenue that can pay your taxes, insurance, and mortgage.

However, rental properties require a large amount of capital to cover maintenance expenses. Investing in your 40s can be highly profitable if you adopt this classic investment method as it guarantees you a consistent income while the value of your assets is rising.

The Bottom Line

Considering the range of investment opportunities available to you in your 40s and 50s, you should take advantage of them without hesitation.

Your first step would be to find the approach that best suits you in terms of time commitment, expenses required, etc.

Additionally, you are not bound by any one strategy because most of the skills that make you successful in the investment industry are transferable.

In order to enjoy worry-free retirement, you need to decide preferred market entry strategy and start investing right away.