Ever wondered, "What is a land bank?" It is one of the most promising investment opportunities with low-risk factors in real estate. Investing in land banking opportunities has several advantages; even in inflation, investors are safe from hazards.

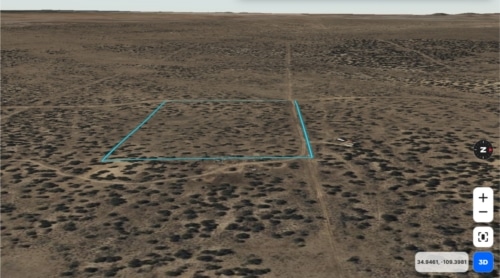

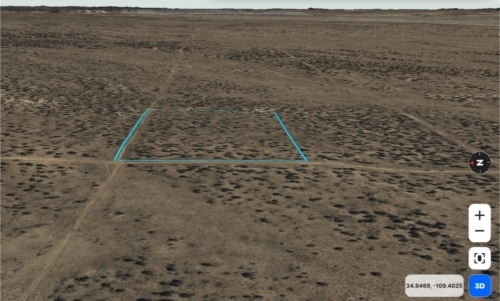

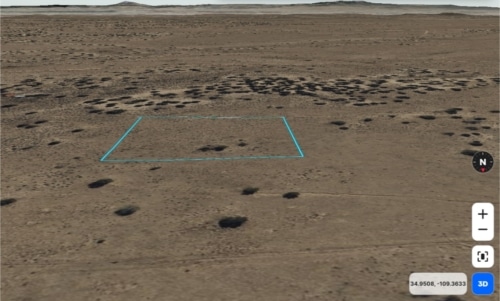

Land banking investment in real estate is the oldest strategy that allows investors to hold on to a portion of raw land and sell it when the land's appreciation value is high. Even beginners who are willing to start their land investment journey with no money can start their journey as a land banker.

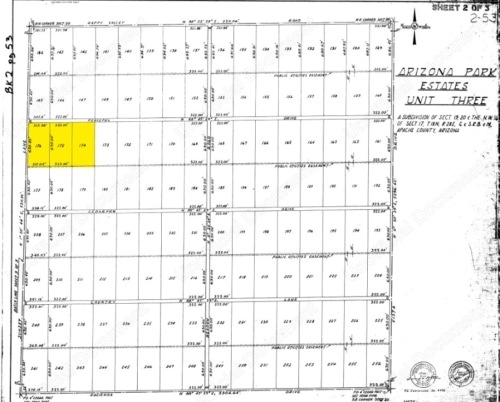

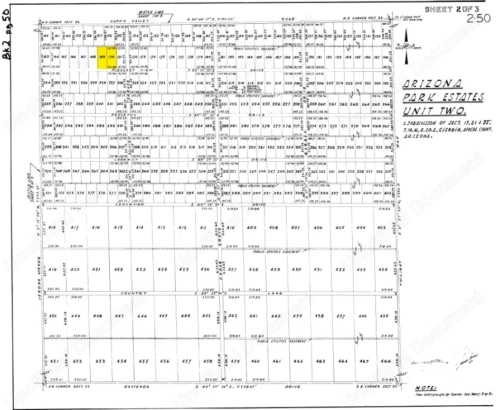

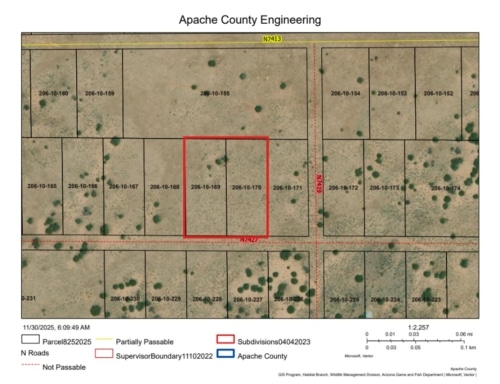

Land banking opportunities shall allow you to own, manage, and invest in land for future infrastructure development. Factors like zoning laws and economic conditions impact returns on land bank properties for sale. They are also primarily essential for investors to comprehend beforehand.

If you are looking to improve your investment portfolio or just seeking an investment opportunity in real estate, it is essential to understand what a land bank.

So, before you start looking for "land banks near me" or "how to buy a land bank property?" Read this blog till the end.

Table of Contents

What Is Land Bank?

For a comprehensive understanding of "What is land banking in real estate?" keep reading below.

If one has to understand what land banks are thoroughly, then here it is. Land banks allow investors to acquire a parcel of land to resell it for land appreciation value.

Comprehending the concepts of this type of land investment is essential for understanding it from its core. It has evolved with time, and now land bank investment strategies have to be compatible with trends and market demand. Acquiring a portion of land for sale without anticipating the future of the area will never be a profitable move.

However, investment in land banking opportunities is promising for high returns in the long run.

Before investing in land, one should be adaptable to the rapid changes in the real estate sector. Conducting thorough research and following a comprehensive land-buying guide is essential to understand the possible complexities and risks.

In this context, the right location, accessibility to amenities, market trends, and political and economic factors determine the high appreciation value of the land. To avoid further complications and risks, builders, land sellers, and financiers collaborate. This approach builds a balanced land banking framework.

Advantages of Land Banking

Now that you know what is land banking, let's take a look at its advantages.

Land banking acts as a tangible asset and carries relatively lower market risk fluctuations than other investment forms such as stocks or bonds. Moreover, carefully chosen pieces of land for sale in demanding locations with potential for infrastructure development possibilities can significantly raise appreciation value. Analyzed financial goals and risk potential make this a wise choice for investors who want to buy land from a land bank to secure their financial future.

Investment in land bank properties for sale presents several advantages for long-term planning. Even new investors who want to start enhancing their investment portfolios can buy with a minimal amount. Just like other investments, land investment also has risks associated with investment, but they are not subject to being affected by market fluctuations. Land investment can be done by anyone to generate passive income without having to maintain and operate things manually.

Here are some benefits of land banking you must know while considering what a land bank is:

1. Appreciation value:

The land appreciation value increases over time because land is a finite resource. In top states to buy land, the increase in population increases the demand for the land for sale, which also increases side by side. Thus, the value of the land is also expected to increase.

2. Safe Against Inflation:

Buying land from a land bank is safe as it is not affected by the sudden shift of the market. Real estate investment is considered safe from the impact of inflation.

3. No Maintenance:

Raw land, while considering how to buy land bank properties near me, usually has fewer recurring costs for maintaining and managing.

4. Potential for Development:

As the population increases, there are potential opportunities for infrastructure and development with the rise in demand for land banks. These possibilities of revenue from investment depend on the zoning laws and regulations.

5. Affordability:

Land banking is more affordable than other real estate investments, such as properties. This affordability encourages new investors and allows them to diversify their investment portfolios without having to invest much hard-earned money. Besides mainstream loans, interested investors can opt for owner financing opportunities to fund their land banking plans.

6. Diversify holdings:

The investment strategy behind what is a land bank allows investors to diversify their holdings in timberlands, mineral development, townhouses, and multi-family homes in urban areas for good returns.

7. Collaboration:

Real estate also provides a fair opportunity for investors to explore segments of land investments. Furthermore, collaborating with local and expert builders and financiers is a great land banking strategy and will be advantageous for investors to enhance portfolios and share the market risk.

Is Land Banking a Good Investment?

This is a prime question that lingers in our minds while considering what is land bank.

Certainly, land bank investment depends on your financial goals and strategies. However, it is a smart investment strategy; even a beginner can start investing in real estate without having to spend a lump sum amount. With very little manual work, real estate investors get opportunities to make money from land banking by considering certain factors. Before buying land, investors should adhere to a comprehensive land-buying guide. As per that, they should evaluate key factors such as zoning laws and the economic condition of the area to ensure their successful land banking investment.

Furthermore, before making any decisions regarding what are land banks, it is also important to be aware of fluctuating market trends. By carefully considering these factors, you can enhance the possibilities of safe investments to get high returns and establish a strong position in your investment portfolio. However, keep looking for expert advice for land banking that will guide you to invest in land and make more successful returns.

Tips for the Profitable Land Banking Investment

Buying land as an investment is also associated with risk, like other investments. Here are some factors and their solutions to be considered to gain an appreciation of land's value.

Understand Zoning regulations:

Property taxes, eminent domain, zoning regulations, environmental laws, and restrictions on land usage are major challenges you might face while buying land from land bank investments. These may affect the profitability of the land investment in the future. Land investors and land bankers must conduct thorough research and seek consultation with legal experts to be aware of applicable rules and regulations on what is land banking.

Analyze the market:

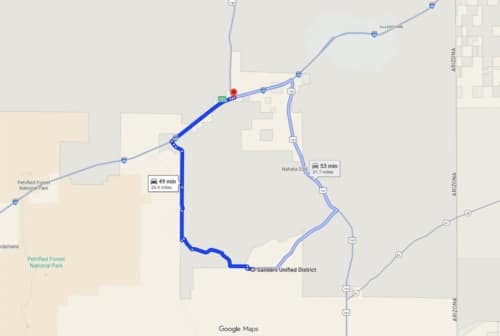

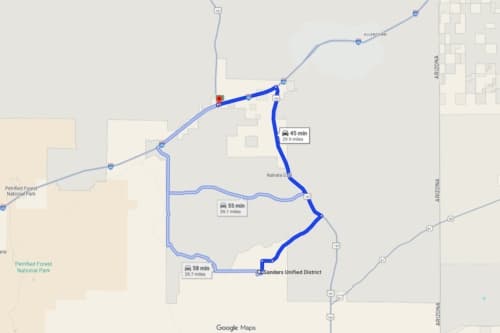

Market uncertainties can impact land demand, supply, and profit for land bankers. To safeguard real estate and land investments, you should carefully watch market trends and plan a detailed land banking strategy. Awareness of factors like population growth, GDP, infrastructure development, and economic conditions can help secure investments in "land bank near me." It also saves your finances from potential market crashes.

Selection of Location:

The advantages of buying land in real estate depend on the location. If the location is prone to natural calamities, it decreases land value and demand. So, you must be careful while choosing the preferred location among the top states in the USA to buy land.

Be Aware of Legal complications:

After understanding the risks that come along with what is land bank. It is essential to implement effective land investment strategies. While looking for top states to buy land in USA, keep yourself informed about zoning laws and market trends to mitigate risks. On this note, diversifying your real estate investment with professional assistance and actively managing your portfolio are strategic approaches to reduce the risks.

Takeaway

To conclude, this is everything you must know about what is a land bank to make a well-informed investment decision.

In a gist, land bank investment seems like a wise investment strategy for preserving affordability. The land values are predicted to rise over time due to increased demand for land and property. If an investor buys a piece of land today, it will surely provide better returns in the future. However, looking for the location and external conditions are influencing factors in land value evaluation. Therefore, for a first-time investor in real estate, you might require professional assistance to execute "how to buy land bank property" strategies well.

Furthermore, in populated countries like the United States, land is finite, and it can give prospective returns. However, it is always recommended to weigh your financial goals before inclining towards a land banking opportunity and investment in real estate with a comprehensive land-buying guide.

If you are starting your investment journey and wondering where to begin, APXN Property is the solution to all your doubts. We offer the best platform that can help you acquire and hold undeveloped land for future appreciation and development potential