It is a very commonly known notion that to reap better benefits from real estate investment, you must purchase cheap land.

Those wishing to diversify their investment portfolios with low-risk, low-cost real estate has an alluring opportunity when investing in cheap land. This is one of the many prominent reasons to buy cheap land. Besides these, other long-term benefits of this strategy are tremendous and include large tax advantages as well as high prospective profits.

If you are wondering whether it is necessary to opt for cheap land investments or not, this blog is definitely for you. This is a thorough examination of the reasons to buy cheap land can be a prudent financial move.

Table of Contents

Reasons to Buy Cheap Land for Real Estate Investment

The following points will take you through the 7 crucial benefits of buying cheap land in United States.

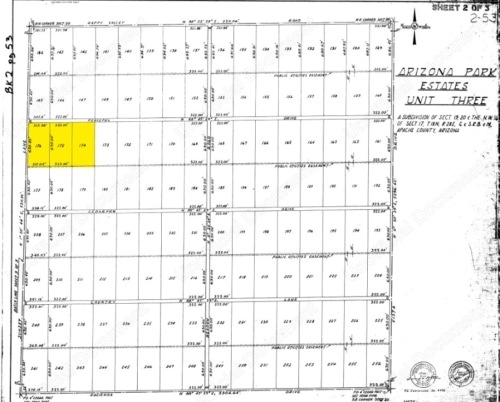

1. Affordable Purchase Price

One of the most compelling reasons to buy cheap land is the low initial cost. Unlike residential or commercial properties, which often require a large capital outlay, land can often be purchased at a more affordable price. This affordability allows investors, especially those with limited funds, to enter the real estate market more easily and even acquire multiple plots, potentially multiplying their investment opportunities.

2. Value Appreciation

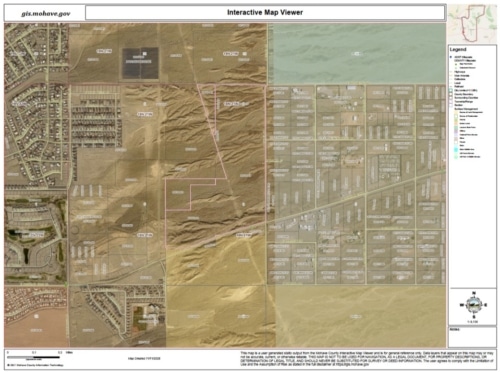

Since land is a limited resource, its value will almost always rise exponentially. As the population increases, the amount of land available declines which leads to the increase in demand for underdeveloped land. Particularly in development-ready locations, the value of inexpensive land might be appreciated significantly. As these regions become more well-known and in demand, land prices rise and provide profitable returns on initial investment for strategic investors.

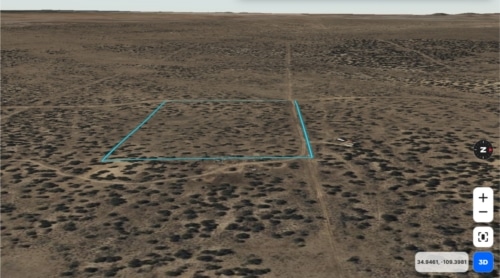

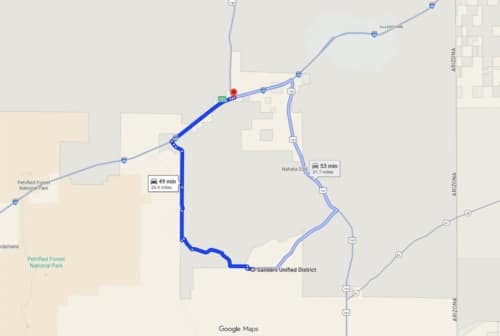

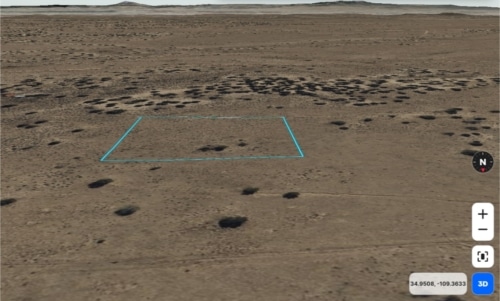

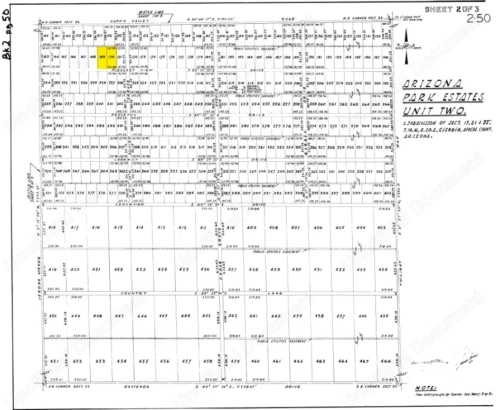

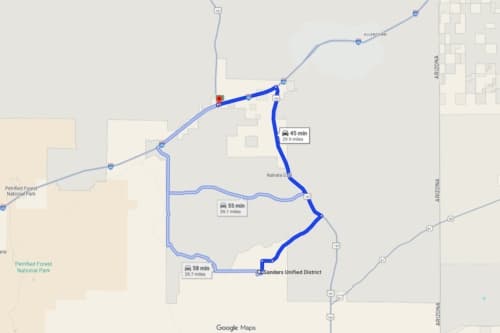

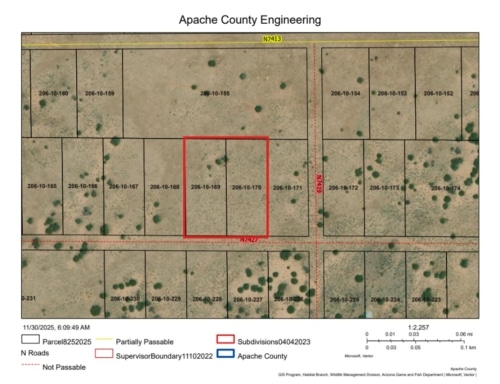

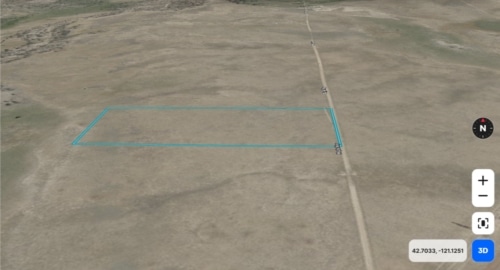

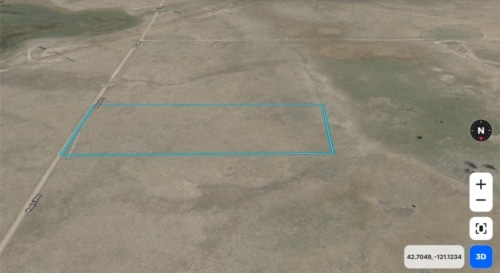

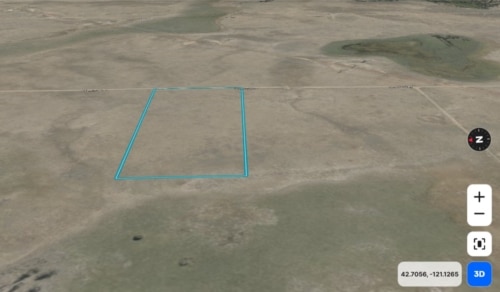

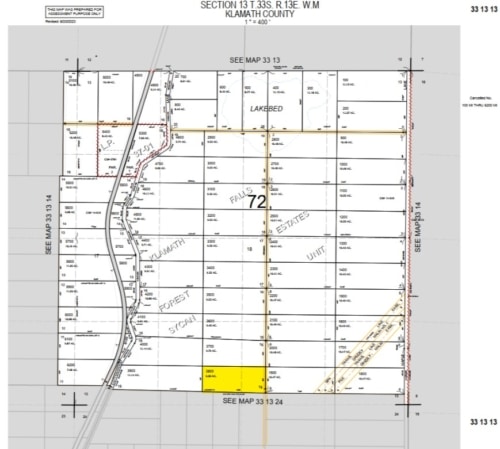

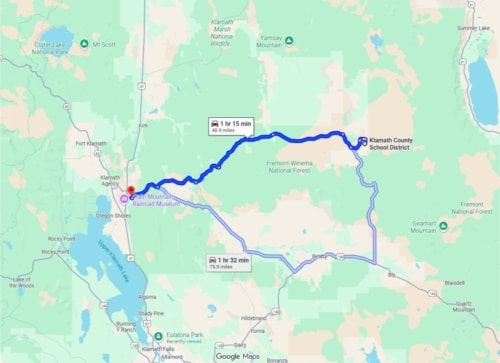

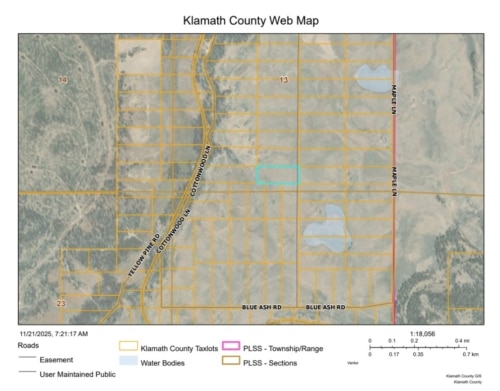

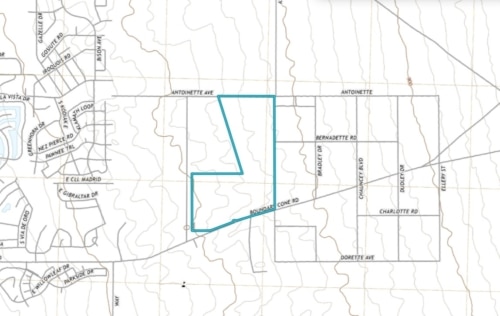

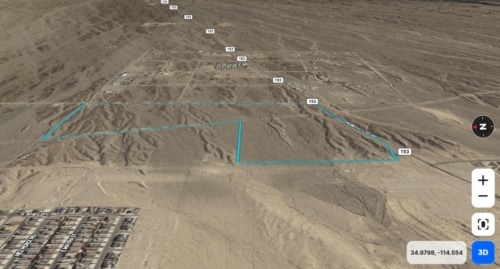

3. Strategic Location

This is another important benefit you must know while discussing reasons to buy cheap land.

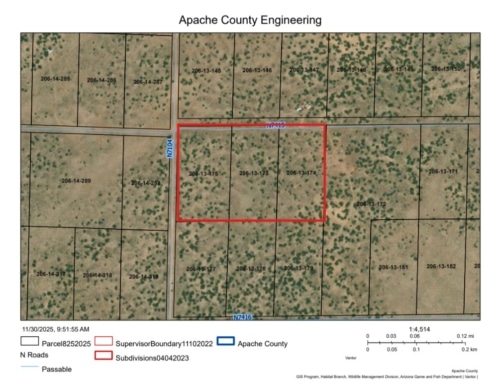

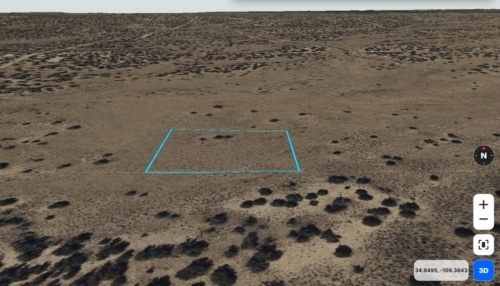

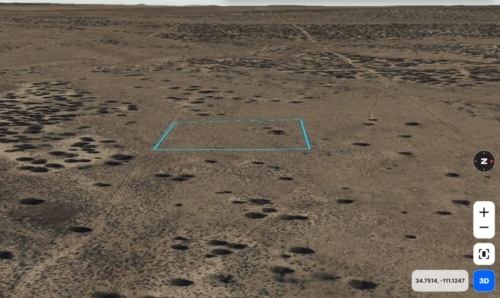

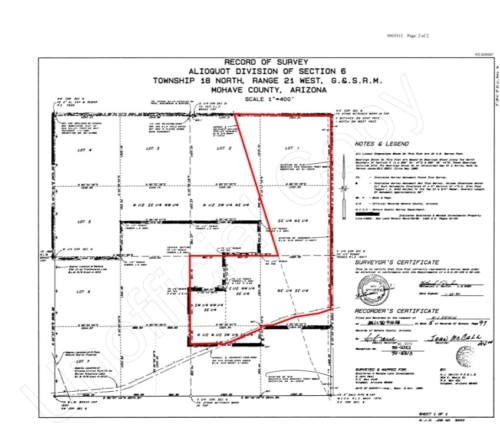

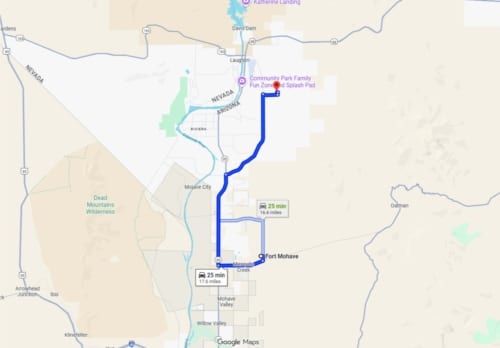

A land parcel's potential for appreciation is mostly dependent on its location. Over time, the value of land near developing communities, large transportation projects, or growing metropolitan regions can rise dramatically. As undeveloped areas are likely to be transformed by urban sprawl or infrastructure developments, savvy investors seek out these opportunities.

By purchasing these previously unnoticed acres at a lower price, they can sell them later to buyers and transform them into highly sought-after properties.

4. Diversification

A good way to disperse risk in your portfolio is to add land. Particularly land, real estate tends to appreciate or stay steady even in periods of market volatility for other investment kinds like bonds or stocks. Because of its stability, land can be held and sold when the time is right, making it a haven in tumultuous economic times.

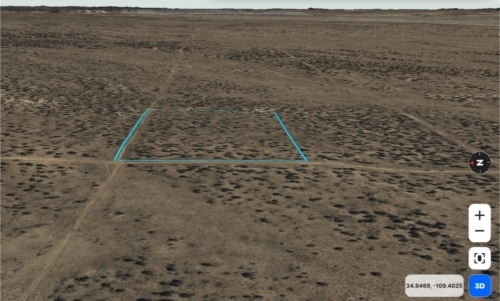

5. Lower Costs to Hold Properties

Another important point to consider regarding reasons to buy cheap land is it comes with a low cost to hold properties as compared to purchasing expensive properties.

Undeveloped land only needs a little continuous upkeep, unlike properties with structures. For underdeveloped lands, there are no structures to worry about, therefore there are no maintenance, remodeling, or management fees to consider.

Moreover, undeveloped land typically has cheaper property taxes, adding to the benefits of buying land. This lessens the investor's financial burden and makes it a wise long-term investment.

6. Tax Advantages

This is another point that you must consider as a valid reason to purchase cheap land.

Land investments may also introduce tax advantages to your finances. Many regions provide tax breaks for landowners, such as decreased property taxes, interest payment deductions, and even incentives for using the land for agricultural or conservation reasons. These benefits might make property ownership more appealing and financially feasible.

7. Less Competition

Lastly, another major point to consider is an investment in cheap land in the United States a worthy move for your finances is the presence of less competition.

The market for affordable land is often less competitive than more traditional real estate markets. Thus it becomes one of the noteworthy reasons to buy land at a lower price. Also, fewer investors equal more possibilities to identify outstanding bargains without having to make rapid decisions. Through this environment, land investors can make thoughtful consideration and due diligence, enhancing the likelihood of making a wise decision.

Sum Up

With these top seven reasons to buy land at a cheaper price, you will be ready to witness significant ROI in the long run.

To conclude, cheap land provides unique prospects for both new and seasoned investors as benefits of buying land. This includes cheap entry costs, the potential for significant value appreciation, and a variety of financial perks such as tax rebates and low maintenance costs.

Furthermore, investing in land is also a simple and effective method to diversify and build your investment portfolio. As metropolitan areas grow and land becomes scarcer, strategically acquiring affordable land today could result in significant financial rewards in the future.