The land is a limited resource though it is economical and offers an abundance of opportunities to attain profits. If bought as an asset to hold, it can appreciate over time to be sold later at a higher price. Also, rural land is a great source to generate passive income through lease or rent.

Beyond the shadow of a doubt, land investment offers numerous benefits. Investors can opt for rural land investment to diversify their investment portfolio and gain higher returns. Even for this type of investment, every seasoned and novice investor must conduct comprehensive research. This shall help them purchase the best rural land for their investment goals.

On this note, this blog shall take you through a few noteworthy things to keep in mind during rural land investment.

Today, we’ll discover some proven ways to pick the best land investment that can maximize ROI.

Table of Contents

Determine Acres

As Leo Tolstoy’s short story, ‘How Much Land Does a Man Require’ indicates, determining the size is a necessity while planning for a rural land investment.

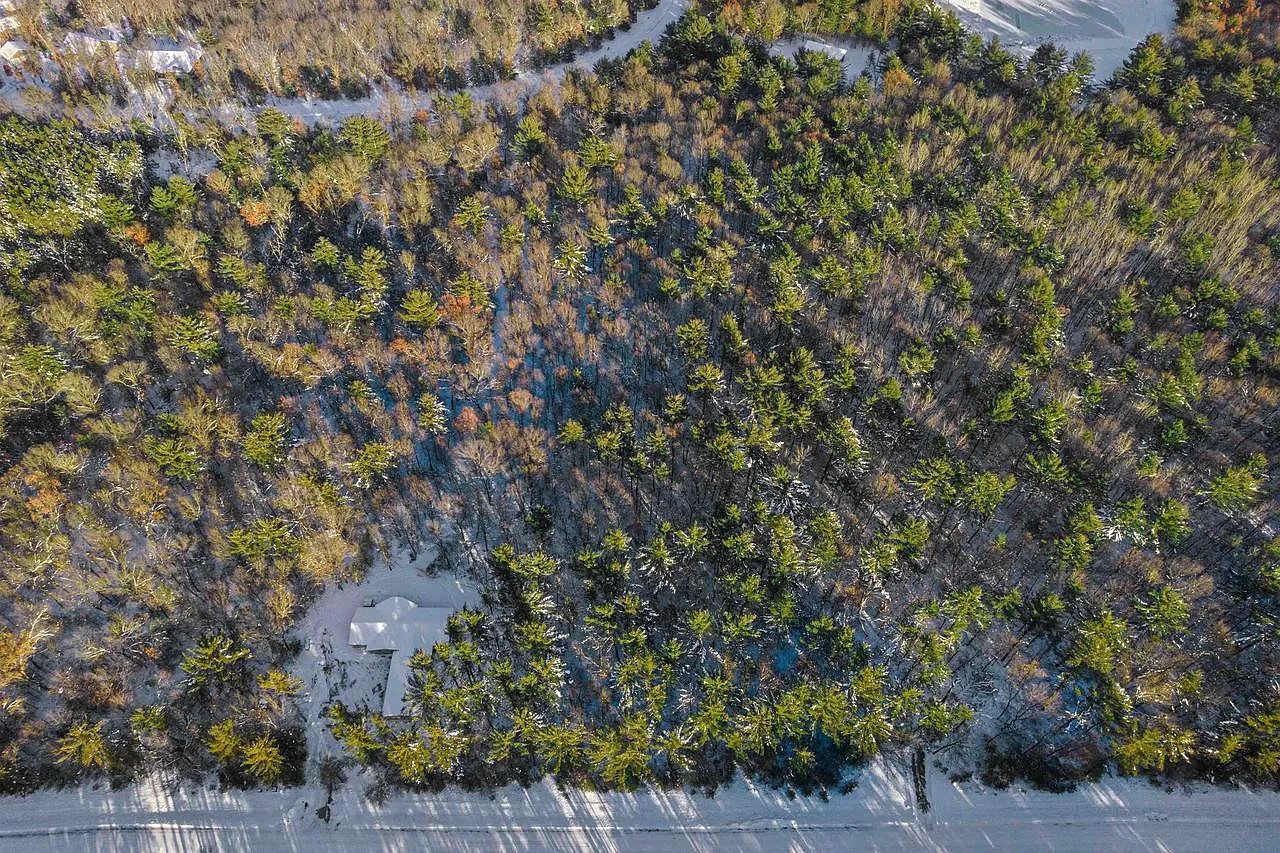

The size of the land should be according to the purposes it is purchased. A large tract of land is suitable for growing timber, crops, or as hunting land at a large scale. On the other hand, a small plot of land for buying rural property would be appropriate for home development.

If you want to buy rural land to sell at higher prices later, investing in a large plot of land is a wise idea.

Market lulls or price drops are an opportunity that allows buyers to purchase rural land at the best price. If you can offer cash to buy land, you will likely get the best deals for rural land investment. Speaking of this investment, you must remember that, the price of land and home development costs should be similar to neighboring properties. Abiding by this ground rule will assist you in qualifying for home development loans

Check Access to Water

Water is one of the essential utilities on which the value of land can vary. Depending on the availability of water supply as groundwater or proximity to nearby water bodies, you can reap benefits of rural land investment.

The demand to buy rural land that has easy access to water is quite high among renters and buyers planning to earn significant ROI from real estate investment.

One of the common benefits of investing in rural land with water availability will attract potential buyers with diverse plans to purchase it at high rates. For instance, you can make more money selling your subdivided land to different buyers who intend to maintain a garden or livestock. To fulfill such plans, investors will always look for land that has a sufficient water supply

Learn About Zoning Restrictions

Zoning is one of the crucial steps from the pages of land buying guide when you are planning a rural land purchase.

On this note, while researching for rural land investment, you must also consider browsing through the zoning laws of the location. These laws ensure a property is used for appropriate purposes to protect or maintain its value. Local and national authorities categorize properties under a few zones; residential, agricultural, commercial, and industrial.

As per zoning laws, residential property is for single-family homes— commercial property is for business services, industrial properties are best for manufacturing, and agricultural property is best for farming purposes.

Thus, it’s crucial to first determine the highest and best use of the land before buying a rural property. If you need land for farming, ensure you buy a property that is zoned agricultural.

Generally, urban areas and surroundings are very restrictive. However, rural areas have fewer restrictions. So it’s recommended to choose the region and buy land wisely as per your needs and expectations when considering how to buy rural land.

Whether you are interested in farmland, raw land, or hunting land for sale in Oregon, Arizona, Florida, or any other state for investment purpose, check out our land for sale listings.

History of the Land

Before purchasing a rural land, consider conducting a thorough investigation. This shall help resolve several queries. It is also beneficial to know about the land’s history to ensure that any unresolved ownership concerns could cause future complications. Such issues might involve instances of outstanding debt or any legal issues that can hamper your rural land investment plan.

You should also keep track of how long the current owner or real estate agent is associated with the property. If they are attempting to sell the land shortly after purchasing it, it could indicate that the property has some concerns. Hence, you can consider refraining from doing business with such parties.

Furthermore, hiring a land surveyor to inspect the land before making the final offer regarding its purchase is a wise decision. A land survey will uncover any potential limits as well as clarify the plot’s borders. They shall also help you with negotiating the terms of ownership and property prices to help you earn better ROI by investing in rural land.

Current State of the Land

When considering land investment, you must do more than simply inspect the property. It is also necessary to determine the nature of the soil in terms of toxicity to ensure healthy growth of plants. You should also think about how the presence of the sun (or lack thereof) will affect the ultimate occupants and agricultural activities of the land. If there are sun-blocking hills in the vicinity, the demand for the property may be greatly reduced for agricultural purposes.

Your decision to purchase will depend on several questions regarding the existing state of the property. Before making a rural land investment decision, ask yourself some simple questions – Will the soil on the land hinder you from drilling a well, building complex structures, or acquiring natural gas, power, etc?

Are there any environmental issues or liens on the property that need to be addressed? Is the land’s elevation going to be a problem?

Why Should You Opt for Rural Land Investments?

Investing in rural land is a choice that can provide you with multifold benefits. With this, you can have numerous options for making a profit if you own farmland. Some options require you to work to have an active involvement such as growing and selling crops.

These are not the only advantages of owning rural land. The other benefits include:

- Rise in Demand: By the year 2050, the food demand is expected to increase by up to 98%. This will increase the value of farmlands and crop production. You should purchase or start investing in lands now to reap tons of benefits in the future. As Mark Twain said – Buy Land, They are not making it anymore.

- Tax Benefits: An agricultural investor is allowed several tax benefits from the government. Some of the most common tax factors that must be considered are –

- Depreciation: Agricultural land does not depreciate. With the increase in time, the value of such land is only predicted to rise, unlike the apartments, houses, and flats that depreciate. It in turn saves the costs that are involved in the maintenance of the land and earns better ROI from rural land investment.

- Conservation Trusts: There are several conservation trusts that you can put your land to earn diverse benefits. This includes property tax, etc. Such trusts assist in preserving the ecosystem, the natural ground, and water resources. These help your land to remain privately owned and you can efficiently grow your wealth with rural land investment.

- Property Tax: All states in the US have favorable policies related to agricultural land. These include policies that assist farmers in claiming ownership of their lands. Furthermore, these policies also prevent threatening expansions from outside parties. Low property tax enables the reduction of the investor’s liability.

How Does a Landowner Make Money?

Farmers and ranchers aren’t the only ones who benefit from investing in rural land. A study conducted by USDA, National Agricultural Statistics Service concluded that 31% of agricultural landowners do not operate farms themselves, but instead rent or lease their land to farmers. It also stated that the non-operator landlords owned more than 282 million acres of farmland in the US out of 911 million acres of land. They collected the regular returns due to their farmland ownership without having to manage the day-to-day operations.

Ways in which you can generate money through rural land investment:

Buy and Rent the Land

This is the most common method of generating a sizable passive income through rural land investment. Once you determine that the land is usable and capable of generating returns, you can rent it to a rancher or a farmer. For this, you should set a substantial budget before making a purchase. USDA states the average land price was $3380 per acre in 2021.

You have several options when you decide to earn money by renting your land.

- You can also buy land through a sale-leaseback agreement. Here, the existing farmers will continue to work on the land and will start paying the rent to you AKA the new owner of the land. This agreement gives you a direct path to earn a passive income from rural land investment without undertaking farming-related efforts.

- By investing in rural land that is not currently in use for agricultural work. In such case, you can convert the land as pastureland, or as an urban farm. This will be a profitable move, as you will receive the land at a lower price. However, this also requires extensive effort as you will have to convert the land for farming usage. You must also identify the appropriate crops that can sustain the soil and climate here and hire skilled farmers to work for you.

Investing Platforms

Currently, there are two REITs (Real Estate Investment Trusts) that are publicly traded and specialize in rural land investments and lease them to farmers.

- Farmland Partners

- Gladstone Land Corporation

- Iroquois Valley Farmland

Farmland Partners: It is the largest publicly traded REIT in the US. In the year 2019, it had approximately $1.1 billion in assets. This includes around 158,000 acres of US farmland from seventeen states. The organization leased the owned rural lands to over 100 tenants. These tenants cultivated close to 26 different varieties of crops.

In terms of rural Gladstone Land Corporation: Land investments, this body owned around 111 farms which totaled 86,534 acres of farmland across 10 states in 2019. These were worth $876 million and were used in the cultivation of nutritional foods.

Iroquois Valley Farmland: It is a public non-traded REIT that is available to all for rural land investment. However, it does not trade in the stock market. It focuses on owning only the organic farmlands where the minimum investment required is over $10,000. If you invest in this corporation then it will generate a level of returns but you won’t be able to redeem your shares for a minimum of 5 years.

If you do not have a hefty bunch to purchase land but are looking to invest in rural lands, REITs are an appealing source. This is an easily accessible and low-cost method that you can choose to buy rural lands. If you can purchase one share through your brokerage account, you can start generating passive income through your shares. However, these REITs also trade on stock exchanges thus, can be risky if you do not have sufficient knowledge of stock market.

Crowdfunding Platform

Besides these, you can also use internet-based rural land investment platforms. This is an intriguing option that has gained a high level of preference in recent years. There are several platforms available that can assist you in buying rural property.

Farm Together: This online marketplace is available to all accredited investors for farmland investments. With this, you can gain direct access to various pre-vetted rural land investment opportunities in the US. Furthermore, you can also invest directly in your preferred farms or a fund that is cumulative of several farm investments.

Steward: This crowdfunding platform focuses all its efforts on sustainable rural land investments. It provides the farmers with loans that are used to sustain as well as expand the farms. The lowest amount of investment they allow is $100 which is available to all investors and farmers.

Harvest Returns: Harvest Returns is a crowdfunding platform that provides various kinds of agricultural deals to its accredited investors.

FarmFundr: This platform enables its investors to invest in all kinds of agricultural as well as farmland opportunities.

Farmland LP: This crowdfunding platform provides its accredited investors an opportunity to first invest in a private equity fund that has the potential to become a REIT. This also has the flexibility of going public in the future. This platform focuses on transforming the purchased commodity farmland into organic farmland.

AcreTrader: This crowdfunding platform enables all certified investors to purchase their preferred farms directly for rural land investment. It also provides several options for buying rural land to investors. This includes the opportunity to purchase 10 shares i.e. up to one acre of land. The cost which the investor will bear is a minimum of $3000 to a maximum of $10,000. You will further own shares in the LLC i.e. the Limited Liability Corporation (it has the legal title to the land) rather than owning the land yourself.

Bottom Line

This is everything you must keep in mind while considering rural land investment for long-term benefits. In a nutshell, before investing in such properties, consider having a clear idea of your investment goals and financial requirements.

If you are a new investor or have very little idea about the benefits of investing in rural land, consider contacting our skilled real estate experts.