In times of record-breaking inflation, many investors seek effective strategies to protect their wealth. In such a crucial period, people used to find the best option of investments that would hedge against inflation.

As records are breaking yearly and causing serious harm to the economic crises, a sudden downfall turns the world upside down. It is also decreasing the purchasing capabilities.

It is an inevitable force that slows down the economy and causes chaos in the world. It lowers the value of investments and cash savings. This is why investors must diversify their investments to inflation-proof their portfolios!

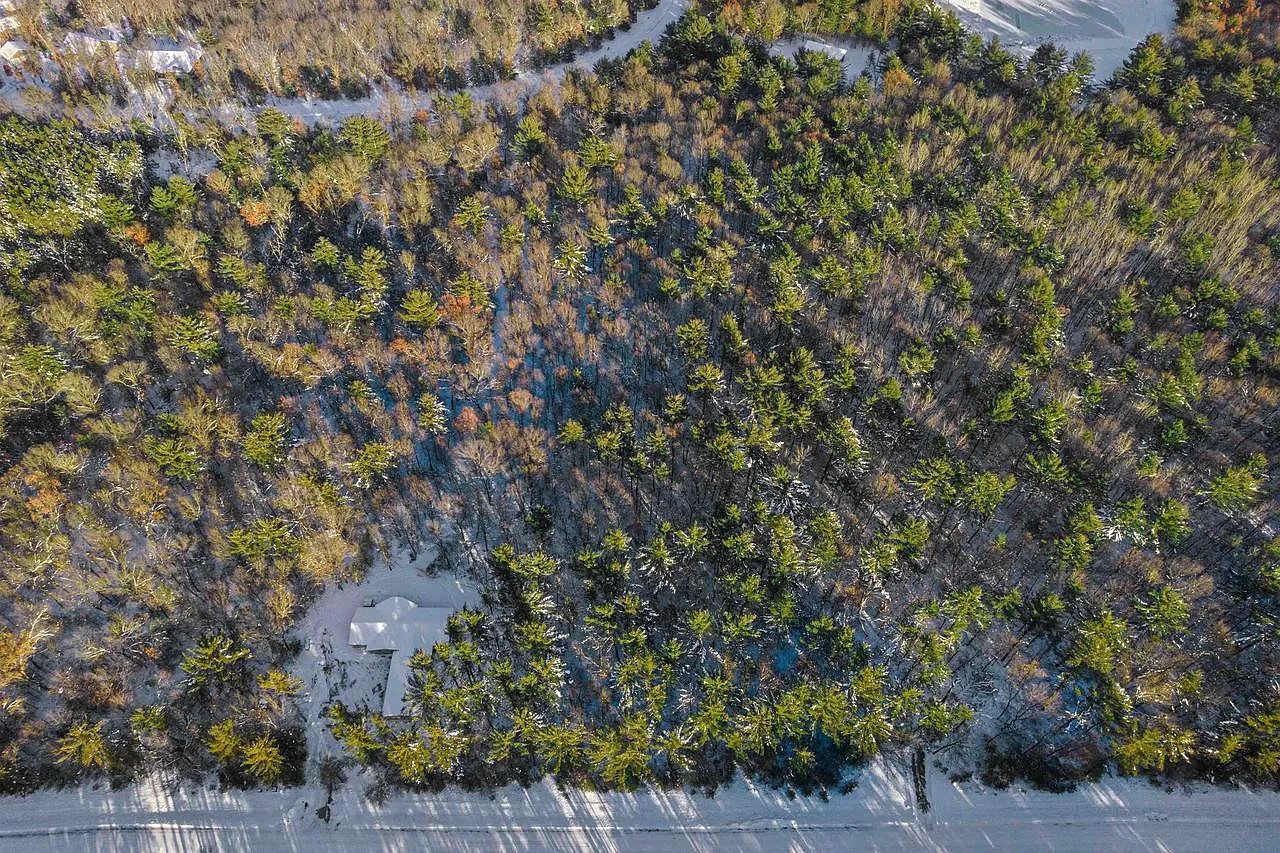

Hard assets are lucrative and possess genuine value. These assets are tangible and also work as a hedge against inflation. With time, many investors earned huge success when they considered investing in land. Although investments are subject to risk, the market is inevitable of such sudden fluctuation. In such uncertainties, real estate land and properties hold long-term benefits and appear to be the best investment choices. However, land can deliver exceptional returns without many risks. Land is the best asset for inflation that ensures the safety of your capital.

Unquestionably, inflation cannot be ignored or overlooked as it is an integral part of the financial system. Moreover, the post-pandemic period requires investors to safeguard their portfolios against inflation.

Table of Contents

What’s the Best Hedge Against Inflation?

The best investment strategy to remain secured during market fluctuation is portfolio diversification.

Investors need to consider diversifying their portfolios as a strategy to safeguard against the adverse impact of inflation. Diversification involves spreading investments across different assets to reduce the overall risk exposure and protect capital from potential downturns.

When one or multiple investment assets fail to deliver expected returns, other assets cover the damage with returns. As a result, your investments remain unharmed during such a period as land is the best hedge against inflation.

You might have thought of investing in high-performing assets. These include commodities, TIPs (Treasury Inflation-Protected Securities), Real Estate, Gold, Silver, and REITs (Real Estate Investment Trusts).

However, the return you get from these assets can vary. So, you may wonder which is the best asset for inflation. The short answer is the land due to its potential to generate side income and high appreciation. For a prolonged period, land is considered the safest investment choice which has the potential to generate passive income.Back in time, then the cost of agricultural land per acre was $20 in the year 1900. In the United States, there was an average of 4.5% of surge in the cost of farmland per acre over the last two decades.

Is Land a Good Hedge Against Inflation?

Unlike other assets, properties do not depreciate and can provide higher profits than expected. In any market condition property safeguards investors. It is affordable and encourages new investors in their portfolio diversification. Besides everything, the land is prominently used for agriculture.

If we look back in time, the cost of agricultural land per acre was $20 in the year 1900. In the United States, there was an average of 4.5% surge in the cost of farmland per acre over the last two decades.

Farmland price per acre was approximately $4,442 in the year 2019 depicting a $2,394 hike in the monetary value. The value of an acre of land in the least valuable state is approximately $2000. The investment in land is a good hedge against inflation and appears reasonable.

The value of land is primarily determined by its use and location. Developed plots are more likely to have higher prices and appreciate more quickly compared to undeveloped land

Returns on farmland and inflation during 1991-2018

Most investment assets are vulnerable to inflation and undergo value reduction. Whereas land holds its value or at least keeps your investment secure during such time. Investments in real estate make even bad times work for you since they are the best assets for inflation. The biggest advantage of investment is that the market fluctuation does not affect its potential to generate high appreciation.

Related: Investing in Farmland – 6 Easy Steps to Get Started

An inflation-proof portfolio includes land and other tangible assets that aren’t volatile.

Here are some main reasons why land is the best asset to add to your inflation hedge portfolio:

Land Is a Tangible Asset

Land is a finite, stable, and tangible asset, keeping it for the long run can be the best investment during inflation. It never depreciates overnight or loses its value. Owning a plot can offer various advantages such as cash returns on sale, lease income, flexibility of use, etc. Land can serve as an effective way with the potential to hold value and generate higher returns. Other than the monetary benefits its ecosystem services provide water filtration, soil that produces plants, pollination, etc.

Hands-off Investment

Land is easy to maintain asset and thus inexpensive to possess. In real estate, land investment has less competition compared to its alternatives. Due to its ability to hedge against inflation, it is well suited for a hands-off investment strategy. It is a long-term investment and gives its owner peace of mind with a sense of security.

For many investors, a hands-off investment strategy is beneficial because they need more time to monitor their investments.

Land Is a Safe Investment

In real estate, land is the best long-term investment to hedge against inflation. Adding land to your portfolio can yield higher returns without much risk. Investors can lower their portfolio’s volatility and generate good returns and decent passive income by adding property.

It is always an opportunity to invest in land as it generates higher returns through multiple types of properties. You can buy and sell land anytime because the fact is; the land will always be in demand and will not depreciate.

Exceptional Performance over Years

Investors can not only generate desired returns through land but can also make money off their land. Land, particularly farmland, has produced excellent returns, especially during times of high inflation.

Gold between the years 1960 to 2012 increased only by approximately 8%.

On the other hand, Farmland delivered 11.1% impressive returns when the inflation was approximately 4%.

Overall investors find as a lucrative source of earning profit over time. If you are clear with your financial goals and remain patient, land can be the best investment during inflation.

Land Outperforms Alternative Assets

Gold is also a valuable asset to hedge against inflation and has been a popular investment among investors worldwide. However, farmland has outperformed gold during times of inflation. Land ownership indeed comes with the limitation of tight liquidity but is also profitable as a long-term investment.

Farmland provides a better inflation hedge and higher total returns compared to gold or commercial real estate. Land values also increase when farmers can raise prices for the products they harvest.

Investors undervalue and often neglect land and most of the investors see great potential in gold investments. However, land has grown in value higher than gold through the years.

Farmland and commercial land are both lucrative income options and hold investment principles to provide an inflation hedge. Commercial real estate is considered more valuable as compared to

farmland because it is more likely to generate higher returns. However, farmland has won over commercial real estate by generating better returns over time.

Another significant benefit land offers is it supports wildlife and biodiversity. Overall land is a profitable and affordable option even beginners can own a small plot of land to hold for a certain period and build wealth safely.

The Bottom Line

Land has become increasingly valuable over time and is considered the best hedge against inflation. Landowners can protect their portfolios and combat inflation through strategic land investments.

Investors who need to diversify their portfolio can put money into the land along with other tangible investments like gold. If you are still not done with a piece of land as an investment and diversified your portfolio, it’s high time to give it a shot.

We hope that you are convinced that land is the best asset to hedge against inflation. APXN Property provides buyers with lucrative land-buying opportunities in the US to acquire the land of their dreams. Buyers of all types can find the best raw land in Oregon, Arizona, and other states at reasonable prices.