The land is limited, and land investments are rewarding, but people often struggle wondering how to buy land with no money down and bad credit. Experts say land investment is a beneficial option for beginners and expert investors.

Wondering “how can I buy land with no money?”, we generally assume buying an off-grid land parcel and holding it for a few years to achieve higher appreciation. The common belief regarding investing in land is that a big budget is critical to succeeding in land investments. Nonetheless, in reality, having a ton of money is not always a prerequisite for land investment.

You can invest in land with a small budget and earn enough profits by taking wise steps strategically.

Consider keeping in mind the following steps to know how to get land for cheap prices or with a small budget.

Table of Contents

Scrutinize Listings

First things first, even if you are on a shoestring budget and wondering how to afford land for your next land investment, the simplest way to find low-priced land is by listing sites. Plenty of land listing sites are available, in which you can find several lands for sale and buy land without money that has not been sold for over a year.

Other listings go very quickly when you work with a reputable private land seller. So, consider looking out for a financing option such as owner financing if you get the best deal and understand the necessities. Apart from that, we’d recommend you ask for property access or request a delayed closing so that you can save funds along with land investment.

The idea of choosing land as an investment is tempting. Likewise, buying land with no money. It may take longer than expected. To ensure you don’t run out of options, we’re going to discuss other lucrative real estate investment options.

Why Is Investing in Real Estate a Good Idea?

Before delving deep into how to purchase land with no money, let’s take you through some of the reasons why investing in real estate is a good idea. Land investment is considered a good way of diversifying assets. However, it is an extremely inaccurate assumption that you need a lot of money to make a worthy real estate investment. Also, while considering how to get land for cheap, most people are afraid of the risk associated with the investment. Those who do decide to go for it embark on a great investment journey by browsing top states to buy land in the USA.

Low-Risk Learning

This is another point you must consider while looking into the steps for how to buy cheap land and earn higher ROI.

Instead of struggling with buying land with no money, if you start to invest a little, you are already moving in the right direction to witness your portfolio flourish. Eventually, it sums up in real estate, and you will be greatly interested in all this land investment opportunity has to offer. Besides exploring how to buy land without money, this chance to learn more about real estate is great for new investors. You can learn more about how to buy land for cheap and even make mistakes without risking a massive amount of money.

Diversification of Income

Consider keeping this step in mind while strategizing ways for how to invest in land with little money.

Speaking of diversification in investment, it is a great idea not to put all your eggs in one basket. That has a huge potential of incurring losses. Therefore, it is here real estate has proved to give good results over time. It can be one of your chosen forms of investment along with other options such as stocks, etc.

High Returns via Real Estate Appreciation

It is disadvantageous to think that just because you have little money, you shouldn’t invest it in real estate. Arguably, the opposite of it is undeniably true: you can buy land with no money. For this, you must follow a thorough land-buying guide to know how to invest in land with little money. The earlier you start investing, the better results you will receive in the future.

The value of real estate grows naturally by 3 to 5% in a year. Due to high demand and limited land, it will continue to yield great returns to people who invest in land or other types of real estate. Thus, this value appreciation will answer your query regarding why you must know how to buy land with no down payment.

Quick Overview: Types of Land Investment

Land investment is different from well-funded investors, as they have plenty of choices and the budget to support it. They can buy land for recreation, building a house, or investment without breaking the bank.

Now, you must be curious about what land ownership opportunities are available for investors with a tight budget. How can they find the right piece of land to invest in and get a decent return within budget? What to know before buying land? To get a better understanding of how I can buy land with no money or a tight budget, you should be aware of the following land investment categories.

-

Residential development land

-

Timberland

-

Mineral production land

-

Row crop land

-

Commercial development land

-

Livestock-raising land

-

Vegetable farmland

-

Vineyards

-

Orchards

-

Recreational land

Residential and Commercial Land Investments

Both residential and commercial land investments can be lucrative and can deliver higher returns. For small investors researching how to buy land for cheap, there are plenty of land development opportunities that satisfy their budget and time constraints.

Real Estate Investment Trust, or REIT, is an excellent choice for small investors, as it is very low-priced and doesn’t need direct management. It can also be obtained or sold on a real-time basis. These investments, however, prevent landowners from using the land freely. If you want to experience land investment benefits, residential and commercial development can be your choice.

Row Crop Land and Land for Livestock

The next investment option you must know while browsing how to buy land without money is this. You can buy land for running a livestock operation or row-crop farming and use it freely to generate constant income. Still, there are complications investors need to deal with; one of them that shall help you know how to afford land is the overall cost of operating livestock. This is high, and the investment is also riskier.

It’s more likely the large-scale farming operation will put extra stress on a landowner. Thus, experts recommend small investors avoid large-scale operations while assisting you with how to invest in land with little money.

Many small investors may not like the idea of traditional row crops or farming operations. For them, agricultural investment options can be profitable as they offer exposure to farming enterprises. To give you an idea, some funds provide exposure to coffee, wheat, cotton, sugar, Kansas City wheat, canola oil, corn, cattle, cocoa, lean hogs, soybean meal, feeder cattle, and soybeans.

If you are interested in investing in specific traditional farming operations, use exchange-traded notes (ETNs). You can leverage exposure to soft commodities, including sugar, cotton, coffee, corn, wheat, and soybeans, with iPath Bloomberg Agriculture Subindex Total Return ETN (JJATF).

Besides that, small investors can appropriate investment exposure to cattle and hogs by iPath Series B Bloomberg Livestock Subindex Total Return ETN (COW). There are some risks involved in these investment options. Thus, thorough due diligence is crucial to know potential risks and rewards to safeguard your funds when making such investments.

Small Farm Investment Opportunities

This is another crucial land investment opportunity you must make note of when considering how to buy land without money.

Small investors who desire steady cash flow and want to enjoy land ownership must invest in timber farms, recreational land, orchards, mineral development lands, and vineyards. Such investments pay off as investors get the opportunity to adjust the scale of purchase and generate a stable income stream.

Investors might consider exchange-traded funds (ETFs) and exchange-traded notes (ETNs) for small-scale farming operations.

Real Estate Crowdfunding

This is another important type of land investment method that you need to know while researching how to purchase land with no money.

Real estate crowdfunding lets you add a property to your real estate portfolio without investing a huge sum in it. There are several online investment platforms available that enable you to invest in a real estate property like land for sale with other investors. There are various large commercial real estate projects that are managed by the developers themselves.

You can think of it as loaning money along with other small investors to the real estate developer. This generally is for a predefined time frame, and the minimum amount to be invested is quite affordable.

One of these crowdfunded real estate platforms is Fundrise. This is one of the best ways to buy land because the popularity of this platform is increasing daily, as it lets investors start investing in multi-million dollar projects with a minimum of $10.

Similar to this, another minimum investment crowdfunded real estate platform has arrived. This platform is popular for offering investment opportunities in single-family homes. The minimum investment you can make is $10, and you can learn the ins and outs of the residential properties. There are various other crowdfunding platforms that you can opt for, such as CityVest, Streetwise, CrowdStreet, Yieldstreet, etc.

Hard Money Lenders

Arranging investment funds from hard money lenders is a viable option among the how-to-buy-land-with-no-money-down ways. These are private lenders who are known for providing short-term loans for real estate investment. Having fewer guidelines and qualification requirements than a bank or other financial institution, these are easy to secure.

These loans are provided at higher interest rates as the lenders are willing to take up risky projects too. The typical rules include paying back the lenders within 6 to 24 months the entire sum along with interest. Most investors in such situations either sell the property for a profit or refinance it.

Equity Partnerships

You can also consider this method while researching how to buy cheap land for your next real estate investment.

A partnership is a common but creative path adopted frequently in real estate financing. The alliance strategy works by finding someone who is doing or has done what you want to do and working for them. You can’t get such benefits for free, of course. Instead, you can provide value to your partner.

The typical situation in such scenarios is one person investing funds in a property and the other managing the property. If you do not have the capital to invest in land but are willing to invest your time in the management of the property, then you can look for passive investors to partner with you.

Another scenario of such an alliance is when multiple investors join their resources, and that accumulated cash is used to purchase a property. You can find such equity partners by joining real estate groups and increasing your network through events, etc.

Seller Financing

Seller or Owner Financing is a fruitful way of investing in real estate when an investor is unable to secure funds through loans but wants to buy land with no money down. Here, the investor and the seller come to a mutual agreement regarding the payment terms, interest rate, consequences of default, repayment timeline, etc.

You just need to focus your efforts on finding a seller that is willing to take payments over some time or take a lower down payment in exchange for shorter payment terms or a high purchase price. This works great when the deal is a win-win for both parties.

Microloans

When looking for how to buy land without money, microloans are another viable option in land investments that come into existence due to the peer-to-peer economy. Generally, these investors opt for this loan to gear up a new business or a startup to arrange the resources necessary to generate further growth.

As you will be investing using small sums, you won’t be burdened with high interest rates or high qualification requirements. These are open to being issued by a single lender or by multiple lenders at a time.

Real Estate Investment Trusts (REITs)

REITs are companies that have multiple investors combine their financial resources to be able to invest in real estate properties. This is a good source of passive income for investors who are wondering how to buy land with no money. Here, instead of buying land or property, you can invest in the companies that build or manage the properties. One typical advantage of REIT is liquidity.

When you are the owner of a 30% resort, then you will find it quite hard to pull your money out. Especially if the resort is at a loss, very few people will buy your share or the entire resort. However, REITs are easy to sell, like shares of stock. It is highly advised to buy a variety of REITs, such as firms that build malls, hospitals, parks, etc.

This will enable you to diversify your income without having to manage anything. You can refer to it as a pool of real estate assets that are managed by real estate professionals traded freely on SMEs. Furthermore, with this cheap land trick, you can invest in private REITs, public REITs, or both.

Private REITs are difficult to liquidate and require a higher sum of investment. However, the major benefit it provides is that the future price of the shares is predictable.

Public REITs are similar to stock market investing. You can purchase a share and can sell it anytime you want. The price of these shares is extremely volatile. The major downside of investing in REITs is that a good share of profits is distributed to the administrative overheads. The rest is shared with the shareholders.

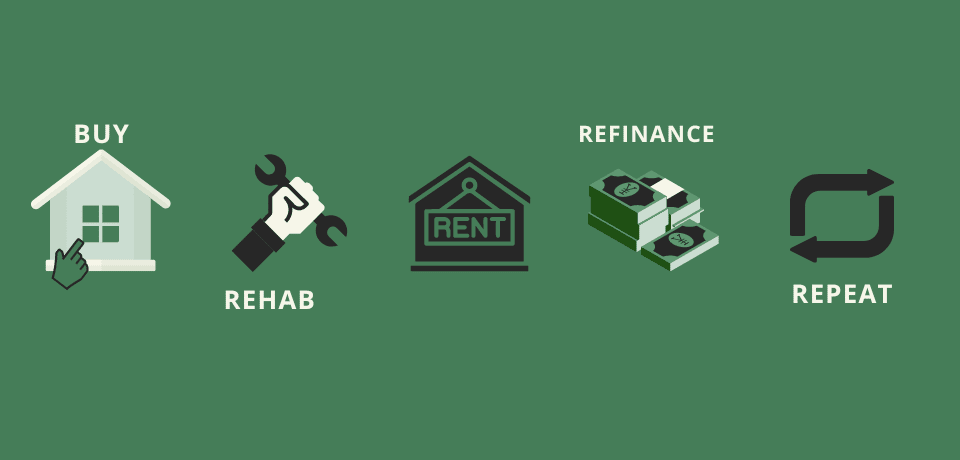

The BRRRR Method

The BRRRR stands for Buy, Rehab, Rent, Refinance, Repeat and is an important land investment type to consider if you are wondering how to afford land with a tight budget.

This is a smart strategy where the first step is to buy a property that needs some substantial repairs. You can find such properties or lands for sale at low prices as they are in some way damaged. Once you complete the purchase at a discounted price, you can renovate it as per the standard rental requirements.

After renting the place, you get the needed rent via your tenants, which you can use to refinance in another distressed property. This process can be repeated as many times as you want, and you will never bear extreme costs. These rental properties will yield a good level of passive income every month. As easy as it may sound, you must do thorough research before diving into a purchase.

You should be able to answer quite a few questions before investing in a distressed property. How to determine the after-repair value of a property, How much rent to charge, what must be the cost of the repairs, which property is worth the effort, etc., are some of these questions. You must also figure out ways to get the initial sum, i.e., the amount to purchase the property and to make the necessary repairs.

Special US Government Schemes & Loans

When it comes to filling the underpopulated zones, the USDA (United States Department of Agriculture) gives mortgages with even a 0% down payment. This mortgage option is generally given to suburban or rural home buyers considering, “How can I buy land with no money?” These are those individuals who come under the bracket of having moderate or low-income levels.

The terms and conditions of these loans are provided on the official USDA site. Such loans are typically offered in towns where the population is 10,000 or less. As most towns in the US are of this size, we can assume that 97% of the United States is secure.

Issues to Consider

This is another important land investment type you must consider while looking into how to invest in land with little money.

Investors need to recognize the legalities linked with the use of a land type before deciding to invest in raw land. Land restrictions in top states to buy land in the US can create a stumbling block to the effective use of the land. So, you better be aware of whether you will need an easement to get access to your property or get a conveyance of mineral rights to bring out and sell minerals for profits. Besides that, a landowner can get access to adjacent waterways with riparian and littoral rights. Small investors should also find out about annual property tax obligations, access to electricity or telecommunications, trespassing violations, etc. Considering these issues, prospective landowners should perform extensive due diligence assessments before purchasing land.

The Final Words

This is everything you must know and remember while considering how to buy land with no money down and reap amazing benefits from your next investment.

A well-planned land investment saves you from risks associated with investment and ensures you reap maximum benefits after selling a property. A variety of ETFs and ETNs are accessible to investors. All they need is to select and utilize the investment products wisely.

If you are a relatively new investor in the real estate market and find this journey overwhelming, we have your back! Explore our website to get access to our fully detailed land-buying guide and the best land listings in the top states of the USA. So, wait no more and start your land investment journey with us at APXN Property.