What comes to your mind when you come across the concept of tangible investment? Precious metals, stones, diamonds, vintage cars, or probably a piece of artwork? Investors should prioritize tangible assets over intangible ones.

Tangible investments like real estate, businesses, infrastructure, commodities, and collectibles are more secure against economic uncertainty and provide higher returns over the long run. However, the land is seen as one of the best tangible investment options among investors now.

Many investors in the US are investing in tangible assets like land as a smart choice as it generates good returns and passive income while being less risky than other investment options.

Table of Contents

Deeper Knowledge about Tangible Investment

Investors often prefer tangible investments, such as properties or land, as they can generate income and appreciate value over time. These assets provide a sense of ownership and can potentially increase in value and leverage appreciation over time.

Investors prioritize real estate investment strategies because lower risk associated with properties compared to other investments in times of economic uncertainty. Later, as a safeguard such investments in tangible assets help in the usage of capital during the economic crisis.

Some valuable examples of Tangible Investment

- Real Estate

- Infrastructure

- Commodities (Metals, Oil, Agriculture, Fish, Livestock, and Forestry)

- Collectibles (Coins and Banknotes, Jewelry, Vintage Cars, Ancient Artifacts etc.)

The mentioned options are considered safe against funds, stocks, and bonds. From beginners to seasoned investors, anyone can buy and hold these options to leverage value appreciation. The longer they hold, the more value they gain.

As per the expert's insights, real estate investments suggest investors keep their investments in tangible assets in terms of returns and financial security. Furthermore, tangible investments work effectively as a hedge against inflation.

Why is the Tangible Investment Crucial?

Popular investments like stocks, bonds, and ETFs are associated with risk but can provide higher returns. However, investors can monitor their performance and growth with the. However, intangible assets have some significant drawbacks. They aren't physical and require a proven strategy to leverage their benefits.

Whereas, investing in a tangible asset can give a sense of security and a higher return on investment. Moreover, tangible assets appreciate over time and double the money. Here is why tangible investment is crucial.

Considering the advantages of tangible investments, one should probably give a thought for investing in land. Still, there are reasons why land as a tangible investment is the best option for investors.

Which Investment is the Most Tangible?

Presently, many tangible investment options are available for investors. Still, only a few can deliver expected returns. Land, Gold, Real Estate, and other Equipment are some examples worth spending money on.

We will earn continuous passive income if we consider the benefits of investing in land. We do not have to worry about additional expenses on maintenance and repair, as land is an asset that remains in good condition for years.

There are plenty of reasons why land is the smartest option as a tangible asset for investors. The land is finite, no one is producing more of it but the majority of investors in the US focus on tangible assets to invest in Apartments, Buildings, Homes, etc. Because of the increased population, the demand for homes and land is also increasing.

Key Reasons Why Land as a Tangible Investment is the Best Option:

Buying the right piece of land helps investors in generating good returns and passive income.

Such value helps to grow capital without taking risks. It has been a valuable tangible investment for beginners and expert investors.

- Raw land investment is a surefire way to hedge against inflation.

- Land investments tend to appreciate in the long run.

- Land ownership offers unique benefits that none of the other real estate and stock investments do.

- Investing in raw land has become a preferred way to earn higher returns and reach tangible investment goals.

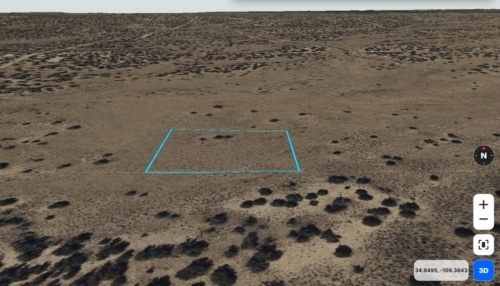

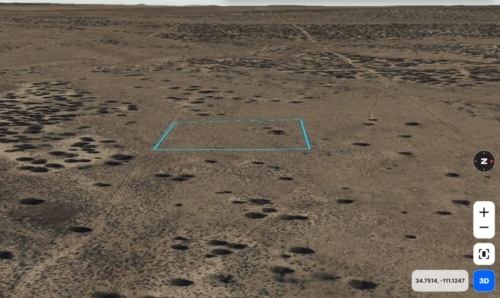

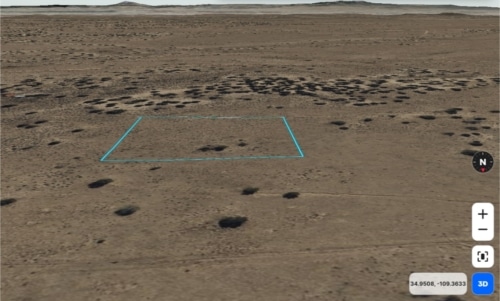

- Raw land is more stable compared to other real estate investments.

- Investing in such land safeguards your money.

- These assets are a tangible investment that will never go to zero and secure your future.

- Vacant land is invulnerable to theft and damages. Moreover, a landowner doesn't need to spend much on maintenance.

- The land is a great alternative for investors to counter the outcomes of inflation.

- You might rent out your land, build a vacation house, or hold it. Investing in raw land pays off.

Where to Purchase Low-Priced Land for Investment in the USA?

Investing in tangible assets does not necessarily require a big fat bank account. You can start your investment journey with a small budget. A few states in the USA have reasonably priced rural land for sale. The following states have the cheapest land per acre:

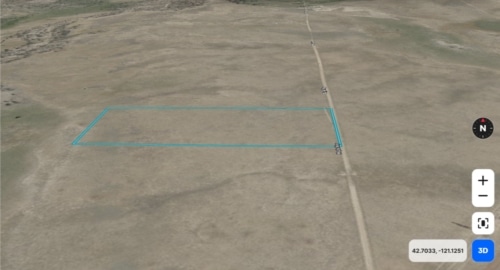

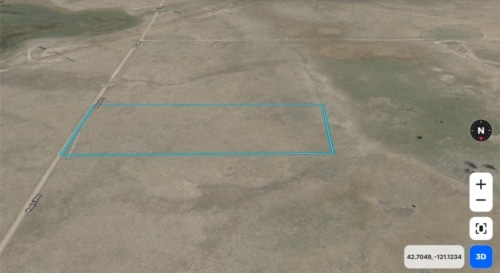

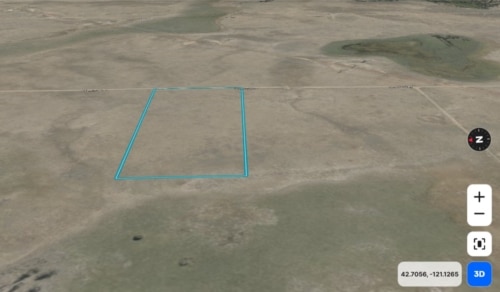

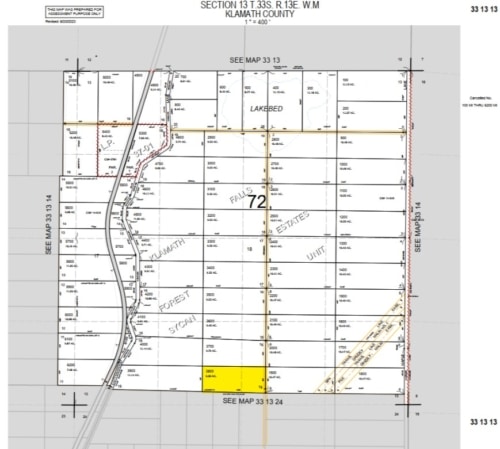

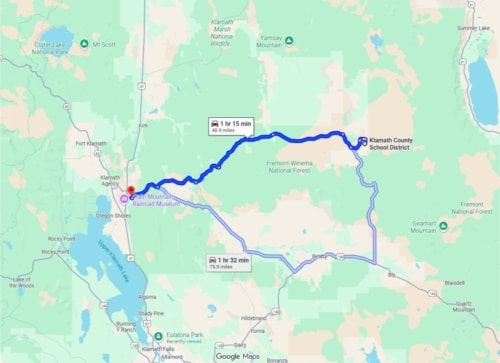

Oregon

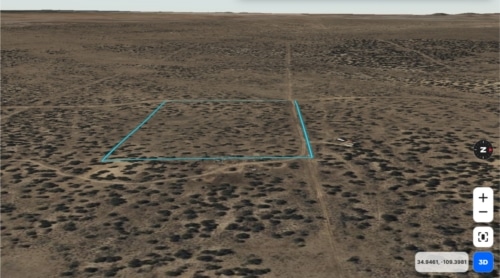

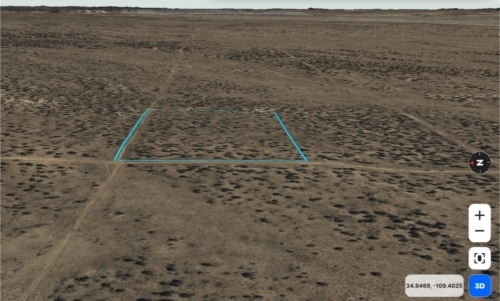

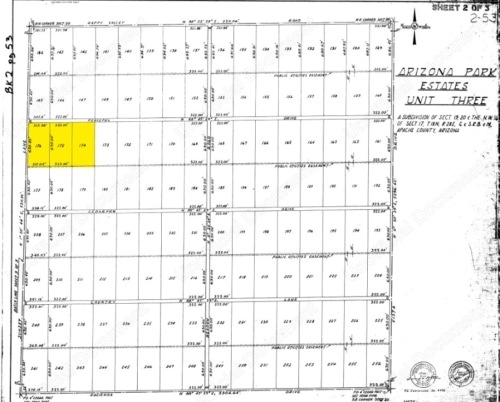

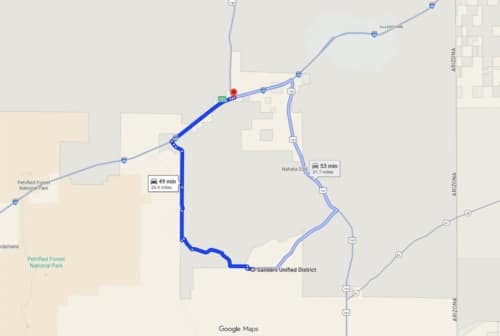

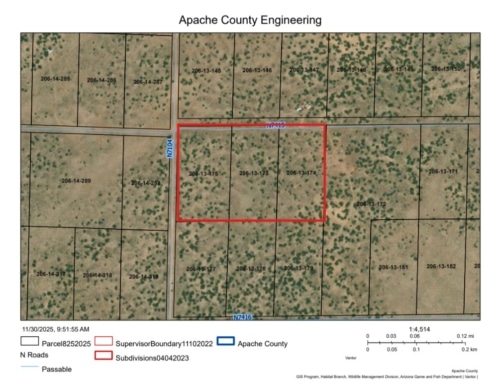

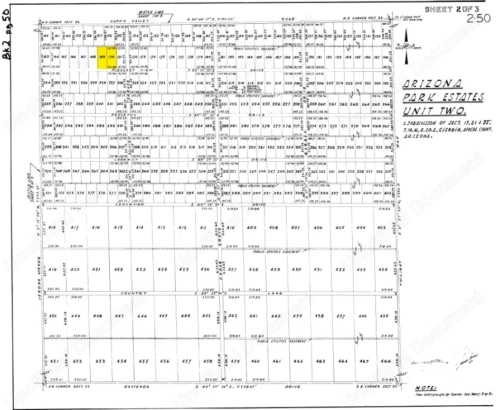

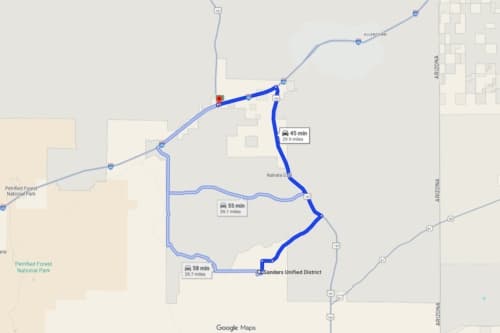

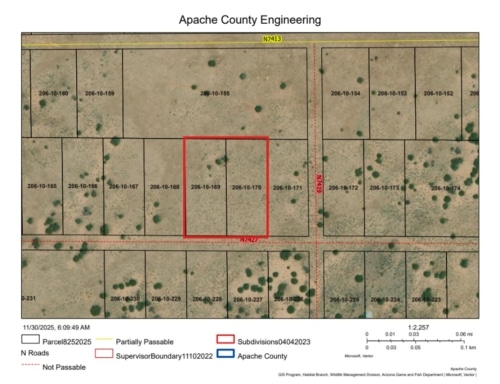

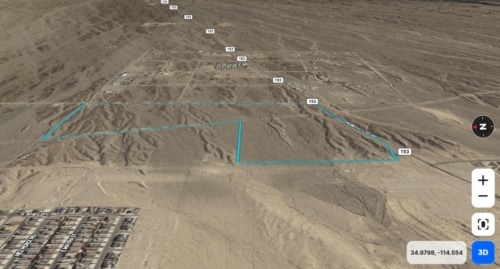

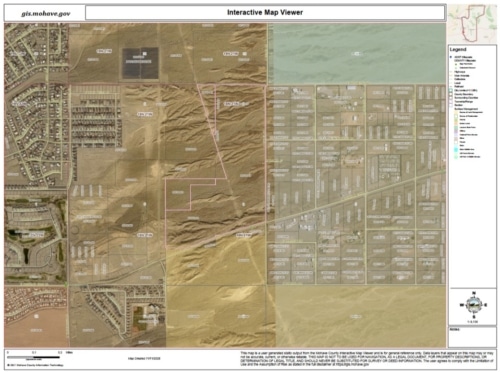

Arizona

New Mexico

Florida

Nevada

You can also prefer our recently published article about –How to Invest In Land with Little Money?

Investing in real estate is a much better option than stocks. And if you want to make the most of your investment, APXN is the way to go. So now you can surely avoid stocks and invest in land.

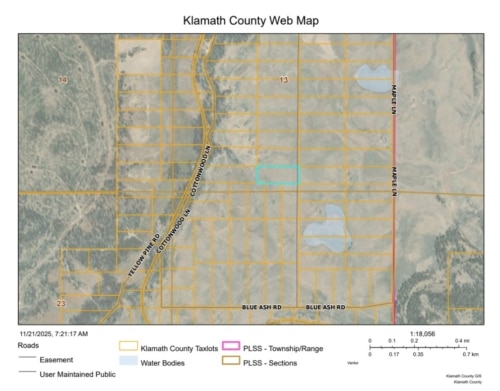

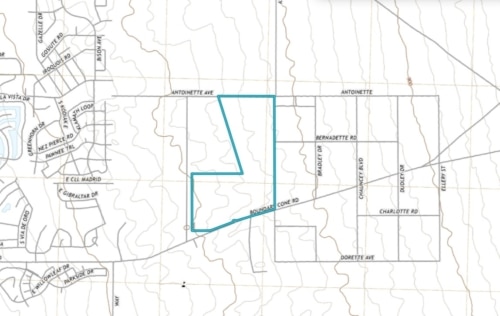

Buying a property through a trusted real estate website can lead you to deal risk-free and can save and earn more. APXN Property is a trusted place to find exclusive land-buying opportunities in America. Here you can purchase the best-priced raw land, undeveloped land for any investment, development, or personal use. It will help you expand your portfolio with the expertise of seasoned investors.

The platform offers affordable rural land in Oregon, Arizona, Florida, Nevada, and Klamath County with instant equity and a money-back guarantee. On top of that, customers get a hassle-free owner-financing facility to help them buy land as an investment.